30+ 30 year mortgage amortization

Web Amortization Schedules for 30 Year Loans Frequently Asked Questions Here are answers to help understand the basic concepts of amortization schedules. Web The rate on the average 30-year fixed mortgage increased to 675 on Tuesday up from 667 on Monday and 655 on Friday.

How To Save 100000 On Your Next Mortgage Loan Nrvliving Real Estate Simplified

Easily Compare Mortgage Rates and Find a Great Lender.

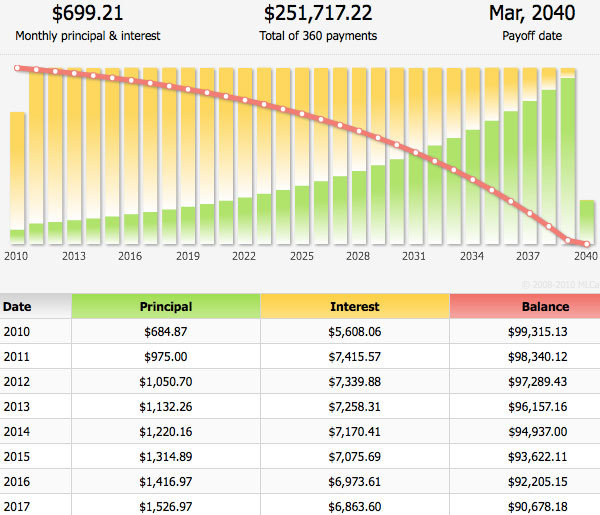

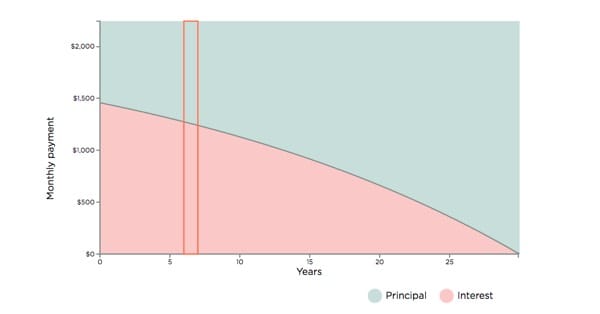

. Ad First Time Home Buyer. Web The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance. Web 17 hours agoThe 648 percent rate for conforming 30-year fixed-rate mortgages FRM was 23 basis points lower than the prior weeks average.

Web If you make your first payment on March 1 2021 then your 30-year mortgage will be paid off by March 1 2051. Check Out Our Best Mortgage Lenders Comparison Chart Find The Right Loan For You. Web For example the payment of a 30 year fixed 110643 loan at 525 is 61097month.

Web Compare the total cost of a 30-year loan versus a mortgage with a shorter term such as 15 years. Subtract that from your monthly payment to get your principal. Ad Get Great Home Insurance Protection Service and Discounts.

Ad 30 Year Mortgage Rates Compared. Web 19 hours agoThe average daily rate for a fixed-rate loan for 30 years was 700 up 3 basis points from 697 the previous day and down 1 basis point from the same day last. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Check Out Our Best Mortgage Lenders Comparison Chart Find The Right Loan For You. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Paying an extra 100 a month on a 225000 fixed-rate loan with a 30-year term at an interest rate of 3875 and a down payment of 20.

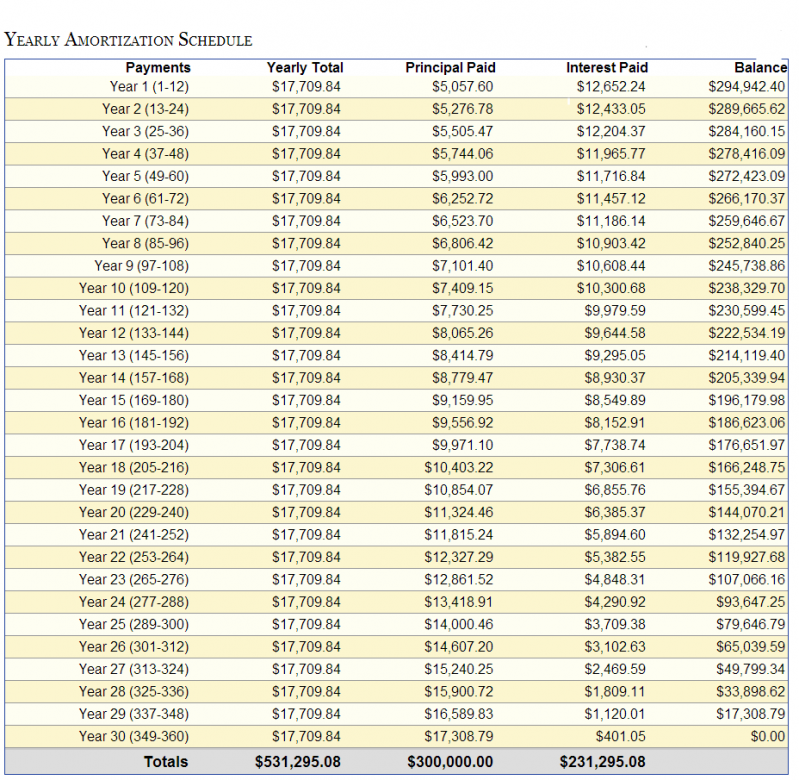

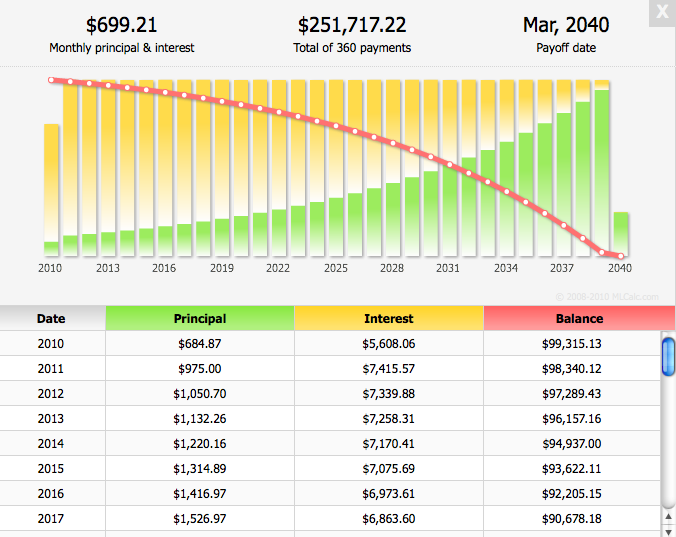

Web See how your payments change over time for your 30-year fixed loan term. Find The Right Mortgage For You By Shopping Multiple Lenders. Web 362 rows The 30 year mortgage amortization schedule shows borrowers how much interest they have to pay in 30 years.

Comparisons Trusted by 55000000. Web The obvious benefit of a shorter amortization schedule is that youll save a lot of money on interest. Web The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan.

A 30 year fixed loan will have a. Ad 5 Best Mortgage Lenders Compared Reviewed. Web 392 rows A 30-year mortgage comes with a locked interest rate for the entire life of the loan.

Dont Settle for Less. Web Amortization extra payment example. But well save you the math and let the calculator tell you the.

Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. Web 30-year Mortgage. At 625 that mortgage payment jumps to 68125month.

30 year fixed loan term. Web Mortgage Amortization Acceleration Example. Comparisons Trusted by 55000000.

For a 30-year fixed-rate mortgage the average rate youll pay is 694 which is a decline of 2 basis points as of seven days. Web Multiply 150000 by 3512 to get 43750. Ad See how much house you can afford.

Points decreased to 066 from. Web 17 hours ago30-year fixed-rate mortgages. Based on the details provided in the.

Ad 5 Best Mortgage Lenders Compared Reviewed. Request A Personalized Home Insurance Quote That Fits Your Needs. 2022s Top Mortgage Lenders.

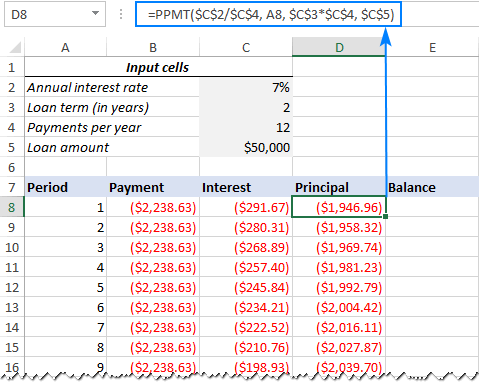

Web Generally amortization schedules only work for fixed-rate loans and not adjustable-rate mortgages variable rate loans or lines of credit. Estimate your monthly mortgage payment. And it flips in the later years of the mortgage.

Because the rate stays the same expect your monthly payments to be fixed for 30. Web Mortgage amortization is a financial term that refers to the process of paying off your mortgage in monthly installments according to an amortization schedule. A 30-year amortization and a 30-year mortgage term.

Costs and Requirements As of late-July 2022 the average national interest rate for a 30-year fixed-rate mortgage was in the mid 5. Select Apply In Minutes. Web 2 days agoA year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394.

It Pays To Compare Offers. Compare Now Save. Web The biggest difference between a 30-year mortgage and shorter amortization periods like 25- or 15- years is the amount of interest youll pay over.

The monthly payment shows the principal interest. Spreading Costs Certain businesses. It also calculates the monthly payment amount and.

For example consider a 250000 mortgage at a 35 interest. Say you take out the same 200000 30-year fixed-rate loan with an interest rate of 4. Thats your interest payment for your first monthly payment.

Get The Answers You Need Here.

Amortization Schedule Over 30 Years Saverocity Finance

Amortization Calculator Remaining Balance Mortgage Choice

Top 6 Ways To Find The Best Mortgage Amortization Calculators Schedule Advisoryhq

Create A Loan Amortization Schedule In Excel With Extra Payments

Housing What Depraved Person Came Up With The Amortization Schedule For Home Mortgages Quora

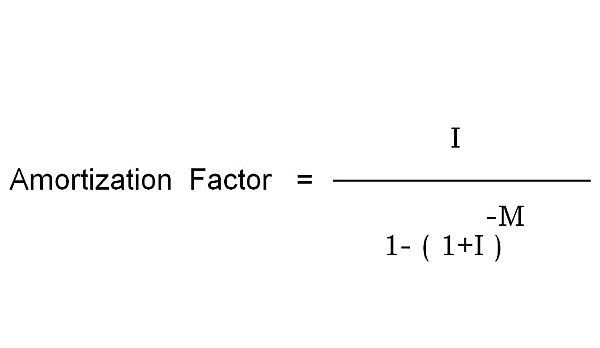

How To Calculate For The Amortization Factor Foreclosurephilippines Com

Amortization Calculator Casaplorer Com

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Mortgage Amortization Revisited The Cpa Journal

Create A Loan Amortization Schedule In Excel With Extra Payments

How To Save 100000 On Your Next Mortgage Loan Nrvliving Real Estate Simplified

What Is An Amortization Period Homewise

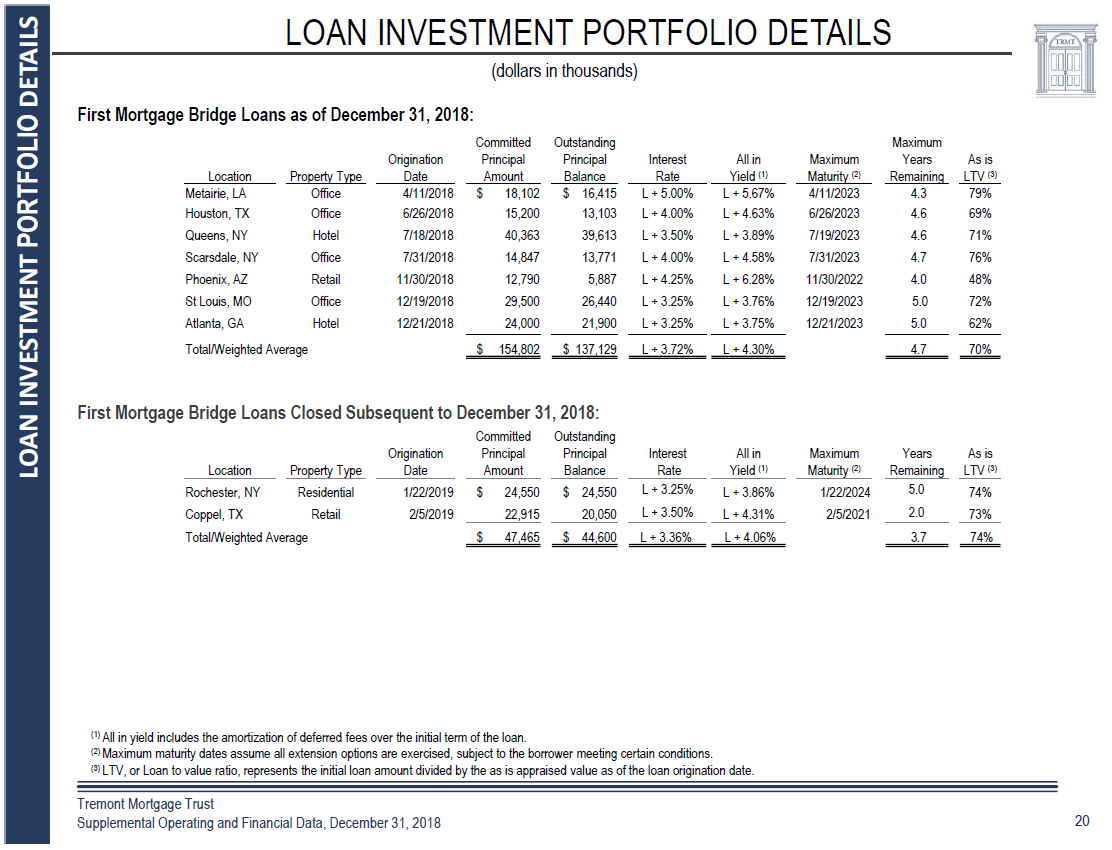

Tremont Mortgage Trust A Microcap Reit Turnaround That Offers A 16 Future Dividend Yield Or 70 Upside Nasdaq Sevn Seeking Alpha

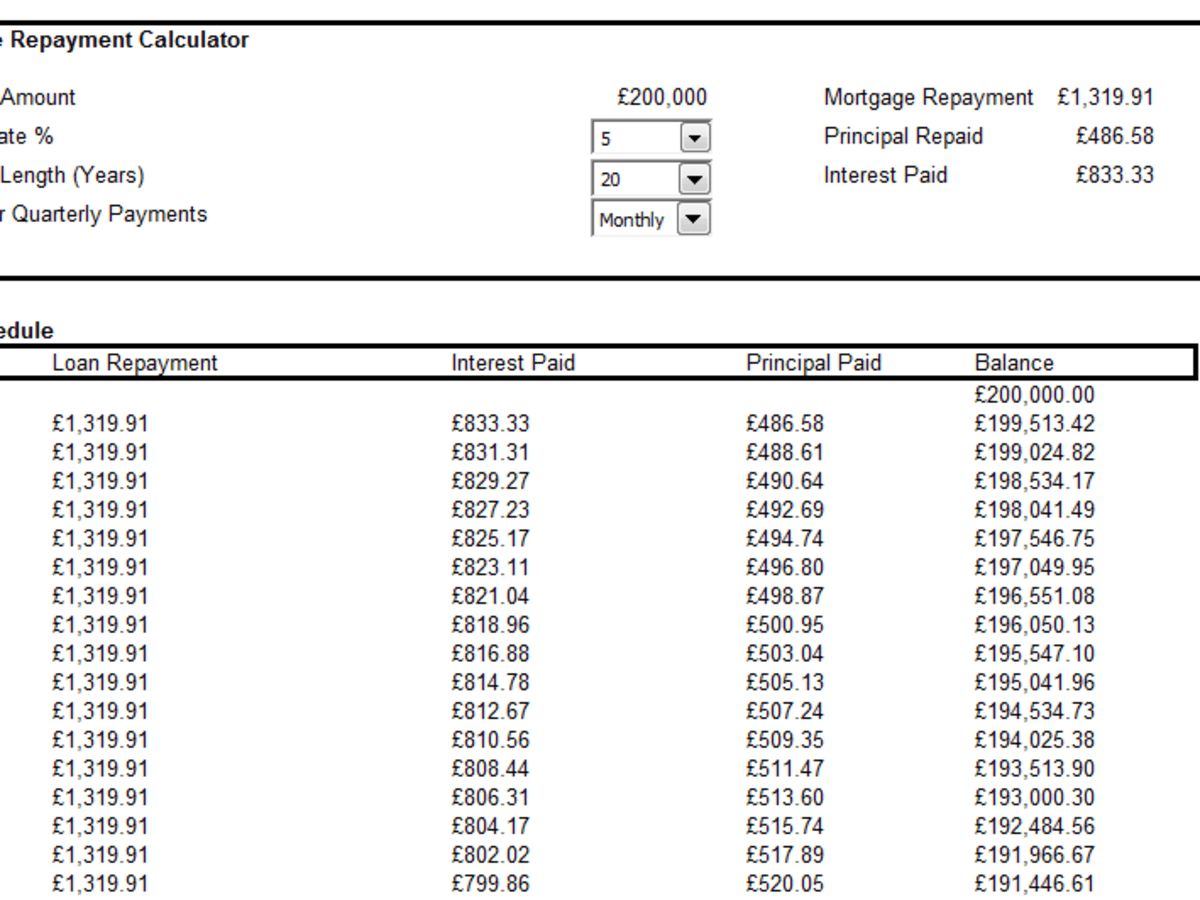

Creating An Amortization Loan Or Mortgage Schedule Using Excel 2007 And Excel 2010 Hubpages

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/O7HV662XA5KU7M7ALPVUWEKOFQ.jpg)

Growing Number Of Mortgage Loans Have Amortization Periods Of More Than 30 Years The Globe And Mail

Understanding An Amortization Schedule Mortgage Capital Partners Inc

Free Interactive Mortgage Amortization Calculator And Table Better Mortgage